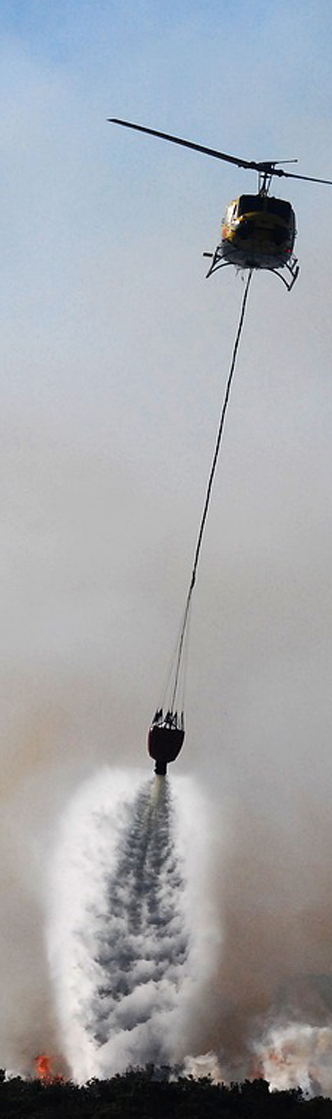

Are Wildfires Covered by Homeowners Insurance?

Fires are commonly covered by insurance, but does coverage extend to wildfires?

Does homeowners insurance cover wildfires?

The short answer? Yes. But if you live in a high-risk area susceptible to wildfires — not always, so it's imperative to check your homeowners insurance policy.

With a sharp uptick in occurrences of increasingly devastating wildfires over the past decade, causing billions of dollars in damage in states like California, insurance companies are working quickly to protect themselves from the liability posed by the unpredictably destructive nature of wildfires.

While accidental house fires caused by things like faulty appliances and electrical wiring are among the standard risks covered by homeowners insurance, this doesn't necessarily hold true for wildfires. Insurers are reluctant to cover wildfires as a whole because of the typically astronomical amount of damage that occurs when one happens to strike: California suffered more than $11 billion in covered losses in 2018*, making it the most destructive wildfire season on record in the state.

While wildfires are usually considered a form of fire and smoke damage, if you live in an area that's especially vulnerable — like brush-filled canyons and forested areas — insurance companies have been known to refuse coverage by specifically excluding wildfires when writing policies, denying renewals, or pulling out altogether from providing coverage in wildfire-prone areas they deem too risky to insure. Some insurers may require a separate wildfire deductible, so it's crucial to understand what's covered and what's not if you live in one of these regions.

What will homeowners insurance cover?

So you checked your policy and confirmed your homeowners insurance covers not just fires, but wildfires as well. If you suffer a loss from a wildfire, here's how your insurance would work to cover the damages.

Dwelling and other structures The dwelling and other structures portions of your homeowners insurance would pay out to repair or replace your property, along with any detached structures near your

Table of contents

Table of contents

Home, i.e., garages and sheds. If you live in a region vulnerable to wildfires, it's extremely important to set the limit high enough to cover the replacement or rebuilding of your home if it becomes a total loss in a fire, accounting for construction and labor costs.

Keep in mind that if the loss of your house is not an isolated incident, and your whole neighborhood suffers many property losses due to a wildfire, your standard replacement cost might not be sufficient to cover the entire expense of rebuilding — that's because building costs rise commensurately with the sharp increase in demand for construction and labor in areas left destroyed and charred by a wildfire.

There are endorsements you can add to your policy that would extend the limit in the event your standard limit won't be enough to cover the damages.

-

Extended replacement cost coverage: extends dwelling limit by 25% or 50%.

-

Guaranteed replacement cost coverage: guarantees replacement regardless of an increase in construction and rebuilding costs.

Personal property

This provides reimbursements for replacement of damaged or destroyed personal property inside your home, like furniture and apparel, up to the specified limit. This coverage is usually 50% of your dwelling coverage, but it may be increased if you own many valuable items.

Loss of use

If your home becomes inhabitable following a loss and is being repaired, this covers your expenses when you need to find other accommodations. It generally covers hotel and lodging but may also cover food and fuel depending on your policy.

What are fire protection classes?

A fire protection class is a method for determining and measuring the risk of fire in your location. Basically, the closer you are to first responders or hydrates, the less likely your home will suffer a total loss due to fire. This will, in turn, impact your premium. Fire protection classes range from 1 to 10 — 1 being the highest. A fire protection rating is determined by an independent company by many variables including:

-

Amount of available fire trucks.

-

Amount of water pumped per minute

-

Amount of working firefighters

-

Response time

-

Available equipment

-

Distance from fire hydrants

-

Distance from fire stations

Alternative methods to get wildfire coverage

So you checked your policy and it turns out your insurance company won't cover wildfire damage though you live in a wildfire-prone area. There are some options to look into to make sure your home is covered, but be prepared to pay higher premiums for the peace of mind.

FAIR Plans

These state-run insurance programs were created specifically to cover property in high-risk areas that are most vulnerable to risks like natural disasters. Fair Access to Insurance Requirements (FAIR) Plans are available in most states for residents who can't get homeowners insurance elsewhere due to risks beyond their control. There are some downsides to FAIR Plans, however — these policies are may be more expensive than standard homeowners insurance and offer less coverage for the premium you pay. Nonetheless, FAIR Plans will provide coverage in high-risk regions that are otherwise denied by most insurance companies.

The level of coverage and the risks FAIR Plans cover differs since it offers coverage for risks most likely to strike each individual state and region

— for instance, the FAIR Plan in California covers brushfire damage to structures and personal property for up a $1.5 million limit, while the FAIR Plan in Florida will provide coverage in coastal areas for windstorms.

Alternative insurance companies

— premier and surplus lines If your home is worth more than $1 million, you may qualify for specialized homeowners insurance coverage through a "premier" insurance carrier. These companies offer benefits like private firefighters, loss prevention, and more robust coverage options to protect high-value properties from events like wildfires. You may also want to look into obtaining coverage through surplus lines — similar to premier insurers, surplus lines policies provide specialized coverage for risks standard insurance companies won't take on.

Homeowners insurance and wildfires in California

If you're a California resident, you may often hear from authorities that there is no longer a "wildfire season" — the threat of wildfires is now a year-round concern.

Much of the state is vulnerable to wildfires — especially communities that lie along the coast and in the forested regions of northern California, but with the right conditions, they can occur just about anywhere in the state. Each passing year ushers in reports of monumental losses that break records. This is bad news for insurance companies providing home insurance to California homeowners; due to massive claims payouts in previous years, insurers have resorted to voiding policies, non-renewals, pulling out altogether from specific markets, or charging much higher premiums to account for the risk.

As of December 2019, the state issued a mandatory one-year moratorium preventing insurers from dropping policies on policyholders who reside in and alongside specific zip codes that were affected by recent wildfires. If you've exhausted all of your options for fire coverage, consider the California FAIR Plan.

How to prepare for wildfire losses

Once a wildfire starts blazing, it's extremely difficult to predict its movements as its intensity is at the mercy of myriad environmental factors, like the climate, wind direction, and density of foliage. However, you can take proactive steps to help reduce fire and smoke damage. Here are some tips to protect your home if it's at risk for wildfires and brushfires. --

Table of contents

-

Use fireproof materials in the structure of your home: concrete, metal, slate, or clay tile roofing, tempered glass windows, non-flammable materials for fencing, gates, underneath decks, and exterior walls

-

Cover vents and eave openings with non-combustible screens

-

Routinely remove brush, dead shrubs, and vegetation from underneath trees

-

Prune and trim low-hanging tree branches extending over the property

-

Clean debris in the gutters and on the roof regularly

-

Designate a "defensible space" — 30 to 100 feet from the home (at least 100 feet in California) — that will act as the front-line of defense where firefighters can more safely defend your home from the blaze. This area should be regularly maintained by removing dead vegetation and brush and making a "reduced fuel zone" with regular grass-mowing and plants and trees that are spaced-out from each other.